Running a small business means juggling sales, customer service, operations, and finances—often all at once. With so much on your plate, bookkeeping can easily become inconsistent or delayed. That’s why many business owners ask: “Is outsourced Xero bookkeeping really worth it?”

The simple answer—yes.

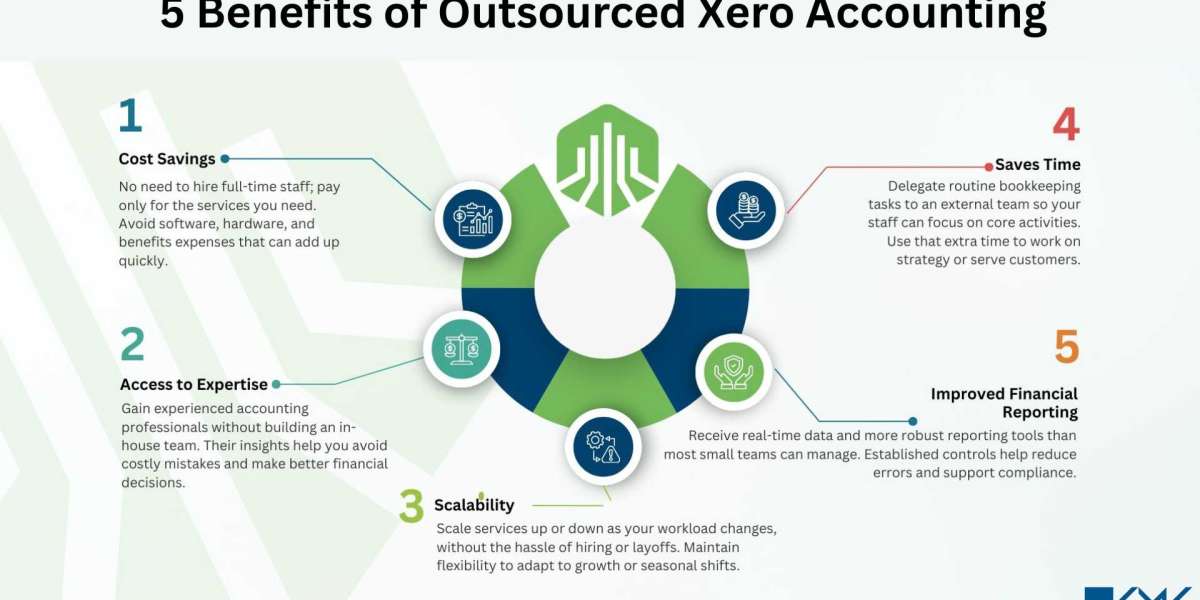

Outsourcing your Xero bookkeeping offers a cost-effective, accurate, and time-saving way to manage your financial operations without hiring a full in-house team. And thanks to Xero’s cloud-based platform, accountants and business owners can collaborate in real time from anywhere.

Let’s break down how outsourcing Xero bookkeeping improves efficiency, reduces manual work, and supports smarter business decisions.

What Makes Xero a Popular Choice for Bookkeeping?

Before understanding outsourcing, it helps to know why Xero is preferred by startups, SMEs, e-commerce stores, and growing companies.

Xero offers:

- Real-time financial dashboards

- Easy bank feed integration

- Automated invoicing bill tracking

- Cloud access from any device

- Secure data storage

- Built-in reporting tools

When paired with the expertise of a professional bookkeeper, Xero becomes a powerful engine for financial clarity and long-term business growth.

- Outsourced Xero Bookkeeping Reduces Errors and Ensures Accuracy

Manual bookkeeping often leads to missed entries, duplicate transactions, or outdated records. With outsourced Xero bookkeeping, experienced professionals manage your accounts, ensuring accuracy across every financial process.

They help with:

- Reconciling bank statements daily

- Categorizing expenses correctly

- Tracking invoices and payments

- Ensuring GST/TDS compliance

- Maintaining clean financial records

Accurate books also mean fewer surprises during audits, tax season, or financial reviews.

- It Saves Valuable Time and Lets You Focus on Growth

Ask yourself—how much time do you currently spend fixing invoices, chasing receipts, or updating spreadsheets?

With outsourced Xero bookkeeping:

- You eliminate repetitive admin tasks

- Your financial workflow becomes streamlined

- You regain hours to focus on sales, marketing, or operations

Small businesses that outsource typically save 30–50% more time compared to handling bookkeeping internally.

- Outsourcing Is More Cost-Effective Than Hiring an In-House Bookkeeper

Hiring a full-time accountant means:

- Monthly salary

- Benefits

- Training

- Management time

Outsourcing gives you expert support at a fraction of the cost, with the flexibility to scale services up or down based on your business needs.

Cost benefits include:

- No overhead expenses

- Pay only for the work you need

- Access to a complete accounting team, not just one employee

For growing businesses, this model is more affordable and sustainable.

- Better Cash Flow Management WithReal-Time Xero Insights

Cash flow is the backbone of any business. Outsourced Xero bookkeepers use real-time data to help you stay on top of inflows and outflows.

With Xero, you get:

- Instant visibility of unpaid invoices

- Alerts for upcoming bills

- Daily cash balance updates

- Cash flow forecasting

- Automated reminders for late payments

This helps prevent shortages, improves collections, and keeps your business financially healthy.

- Enhanced Compliance and Stress-Free Tax Preparation

Tax season doesn’t have to be stressful. With outsourced Xero bookkeeping, your financial records are kept clean and compliant throughout the year.

Professionals ensure:

- Compliance with local tax rules (GST, VAT, TDS, payroll)

- Proper documentation

- Organized ledgers

- Accurate tax filings

- Zero last-minute mismatches

This reduces penalties, delays, and tax-time headaches.

- Stronger Financial Decision-Making Through Expert Insights

Outsourcing isn’t just about data entry. Expert Xero bookkeepers offer guidance, analysis, and reports that help you make smarter decisions.

You get support with:

- Profitability analysis

- Budget planning

- Financial forecasting

- Cost control strategies

- Monthly financial reports

When your bookkeeping is managed by specialists, your business has access to insights normally available only to larger companies.

- Secure Data Storage and Hassle-Free Access Anytime

Xero stores your financial data in secure cloud servers, which reduces the risk of data loss or hardware failures.

With outsourced Xero bookkeeping, you enjoy:

- Secure document sharing

- Instant access to records anytime

- Multi-user login options

- Safe backup and storage

This gives small businesses enterprise-level security at no additional cost.

- Streamlined Workflows and Automation for Higher Efficiency

Xero helps automate repetitive tasks like:

- Bank reconciliation

- Recurring invoices

- Payment reminders

- Expense tracking

Outsourced teams optimize your Xero setup so you get maximum automation, reducing human error and improving overall efficiency.

Final Thoughts: Is Outsourced Xero Bookkeeping Right for Your Small Business?

If you’re looking for a reliable, cost-effective, and scalable way to manage your finances, outsourced Xero bookkeeping is one of the smartest choices you can make. It helps small businesses stay efficient, compliant, and organized—freeing up time to focus on customers and growth.