Managing accounts payable (AP) is no small task. From handling invoices and processing payments to ensuring compliance with tax regulations, this function demands accuracy, speed, and accountability. But in today’s competitive landscape, many companies are asking: is accounts payable outsourcing the smarter solution in 2025?

The short answer: yes. Outsourcing accounts payable provides businesses with cost savings, better efficiency, and the scalability needed to thrive. Let’s break down why more organizations are making the shift this year.

What Is Accounts Payable Outsourcing?

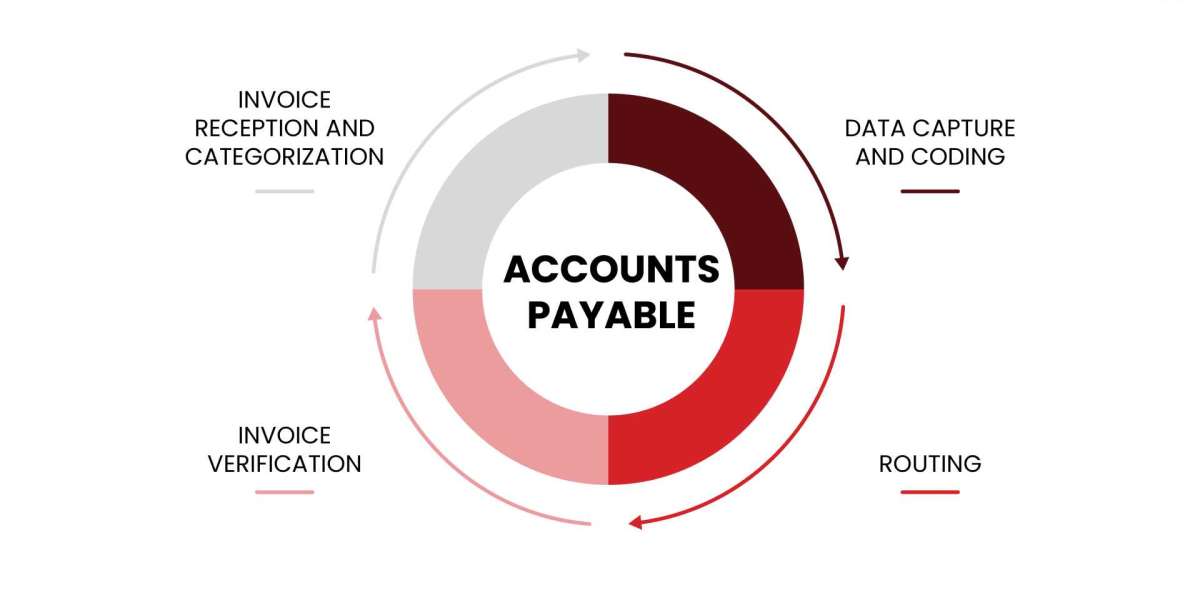

Accounts payable outsourcing means transferring your company’s AP functions—such as invoice processing, vendor payments, reconciliation, and compliance—to a specialized third-party service provider.

Instead of managing everything in-house, you rely on professionals equipped with advanced AP software, automation tools, and financial expertise.

This allows your team to focus on growth-driven activities while ensuring financial processes are managed smoothly.

Why Is Accounts Payable Outsourcing Gaining Momentum in 2025?

Several market changes are driving businesses toward outsourcing their AP functions:

- Economic pressures: Cost control remains a top priority for CFOs.

- Digital transformation: AP automation and AI-backed workflows are reducing human errors.

- Global operations: Companies with international vendors need reliable compliance and scalability.

- Talent shortage: Hiring and retaining skilled AP staff has become expensive.

Put simply, outsourcing offers a flexible, cost-efficient way to keep up with evolving financial demands.

Key Benefits of Accounts Payable Outsourcing

- Reduced Costs

Maintaining an in-house AP team involves salaries, training, software licenses, and overhead costs. Outsourcing significantly lowers expenses through shared technology platforms and specialized expertise.

- Enhanced Accuracy and Compliance

Late payments or invoice errors can damage vendor relationships and lead to penalties. Outsourcing providers use AP automation and strict compliance checks to minimize errors and ensure timely payments.

- Improved Cash Flow Management

With real-time reporting and streamlined payment cycles, businesses gain better visibility into cash flow, which is essential for strategic financial decisions.

- Access to the Latest Technology

Outsourced AP solutions often include automated invoice processing, AI-driven fraud detection, and cloud-based reporting tools—without requiring heavy investment in software.

- Scalability for Growth

As your company grows, so does the volume of transactions. Outsourcing allows seamless scalability without the need to expand headcount or infrastructure.

How to Choose the Right Accounts Payable Outsourcing Partner?

Not all providers deliver the same value, so consider these factors:

1.Industry expertise and track record

2.Data security and compliance certifications

3.Integration with your existing ERP or accounting software

4.Transparent pricing models

5.Flexibility to scale with your business

Selecting the right partner ensures smoother transitions and maximum ROI.

Final Thoughts:

In 2025, accounts payable outsourcing isn’t just about reducing paperwork—it’s about driving efficiency, ensuring compliance, and leveraging technology without overspending. With economic uncertainty and increased competition, businesses that outsource AP are better positioned to reduce costs, free up resources, and focus on strategic growth.