Managing accounts payable (AP) is crucial for every business — but it’s also time-consuming, prone to human errors, and expensive to scale in-house. That’s why more companies now outsource accounts payable services to trusted experts who streamline vendor payments, improve accuracy, and help businesses save up to 50% on operational costs.

But what exactly does outsourcing AP mean? How does it work? And is it safe for your financial operations?

Let’s break it down in a simple, helpful way.

What Does It Mean to Outsource Accounts Payable Services?

Outsourcing AP means a specialized third-party accounting team takes responsibility for:

- Processing vendor invoices

- Matching POs, GRNs, and bills

- Managing AP workflows

- Scheduling secure vendor payments

- Ensuring compliance and documentation

- Providing real-time reporting and dashboards

They work as an extension of your finance team, using:

✔ Your accounting software

✔ Your controls approval rules

✔ Your preferred workflows

So you stay in full control — without handling day-to-day manual work.

Why Do Businesses Outsource AP Services Today?

Outsourced AP solves common challenges like:

- Late payments angry vendors

- Duplicate invoices and entry errors

- Fraud risks

- Lack of process visibility

- High cost of hiring skilled accountants

- Seasonal workload fluctuations

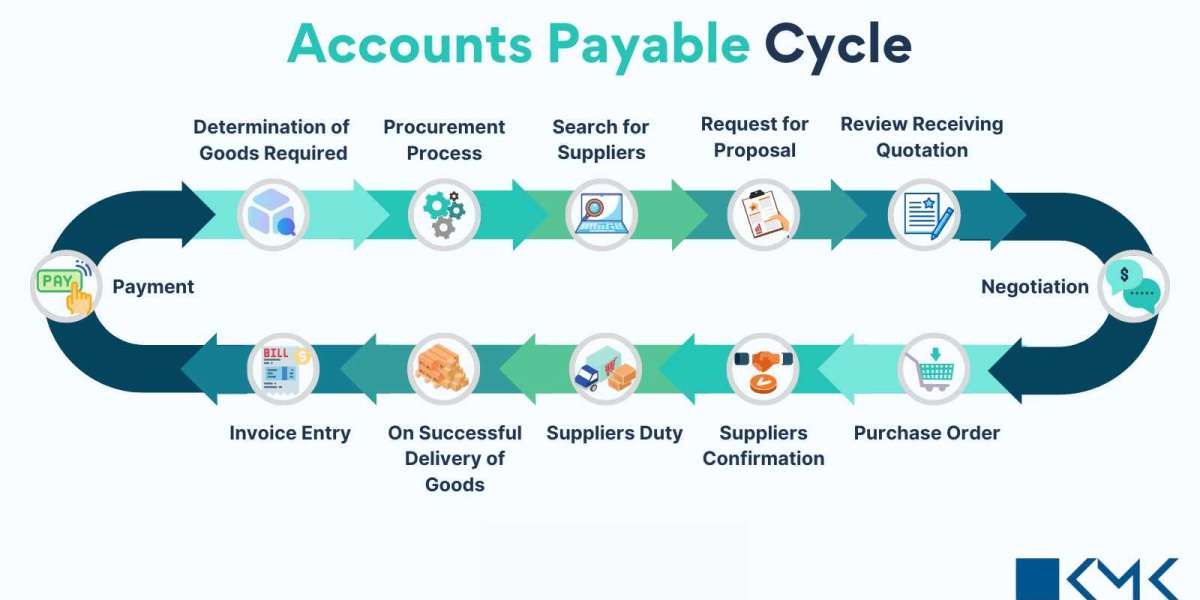

How Do Outsourced Accounts Payable Services Work? (Step-by-Step Process)?

Here’s what the workflow looks like:

- Document Collection

Invoices are received through email, AP portals, or digitized scanning. - Invoice Validation

PO matching, rate checking, vendor credibility verification. - Data Entry Categorization

Entered into your accounting software or ERP. - Approval Routing

Custom approval matrix configured for full compliance. - Payment Scheduling

Vendors paid on the right terms via your banking channels. - Reporting Reconciliation

Regular AP ageing reports, compliance support, and books updated.

This ensures accuracy, traceability, and transparency across every transaction.

Top Tasks You Can Outsource in Accounts Payable

- Invoice processing

- PO creation matching

- Vendor management

- TDS/GST/AP compliance support

- Payment scheduling

- AP helpdesk

- Statement bank reconciliation

- Fraud detection controls

- Month-end closing

AP outsourcing partners can handle all or selected services depending on your business needs.

Who Should Outsource AP Services?

It’s ideal for:

- Small Mid-Size Businesses (SMBs)

• CPA Firms

• SaaS Tech Companies

• Ecommerce Retail

• Manufacturing Logistics

• Healthcare, Legal Professional Services

If you’re handling 300+ monthly invoices, outsourcing delivers huge ROI.

Is Outsourcing AP Secure?

Yes — when you work with a trustworthy provider.

Common security controls include:

- SOC-2, ISO, GDPR-compliant processes

- Role-based access NDAs

- Encrypted data exchange

- Continuous audits cybersecurity monitoring

You maintain complete oversight. Nothing moves without your approval.

How Much Do Outsourced AP Services Cost?

Pricing models vary:

- Per invoice (e.g., $1–$3/invoice)

- Dedicated full-time resource (FTE model)

- Fixed monthly package based on volume

Either way — you only pay for what you use.

Red Flags to Avoid When Choosing an AP Outsourcing Partner:

? No data security certifications

? No accounting or compliance expertise

? Hidden pricing

? Poor communication no SLAs

? No experience with your tools

Always choose a partner who:

✔ Works with your software

✔ Provides transparent onboarding

✔ Improves efficiency from Day 1

Outsource Accounts Payable Services: Why It’s Smart for 2025?

Businesses are shifting from manual finance to AI-enabled AP automation. Outsourcing helps you leverage:

- OCR + RPA technology

- Automated approvals

- Real-time vendor dashboards

This ensures stronger cash flow, speed, and operational resilience — even through economic changes.

Frequently Asked Questions:

Q1. What does outsourcing accounts payable mean?

It means transferring AP invoice processing, approvals, and vendor payment support to a specialized partner who works as your extended finance team.

Q2. Is outsourcing AP expensive?

No — most businesses save 40–60% vs. hiring in-house staff.

Q3. What accounting software do outsourced teams use?

QuickBooks, NetSuite, Xero, Zoho Books, Sage Intacct, SAP, and more.

Q4. How quickly can outsourcing start?

Typically within 1–2 weeks after workflow alignment and access setup.

Final Thoughts:

If you want to:

✔ Cut costs

✔ Eliminate AP errors

✔ Pay vendors smoothly

✔ Scale without hiring headaches

Then it’s the right time to outsource accounts payable services to a reliable partner.