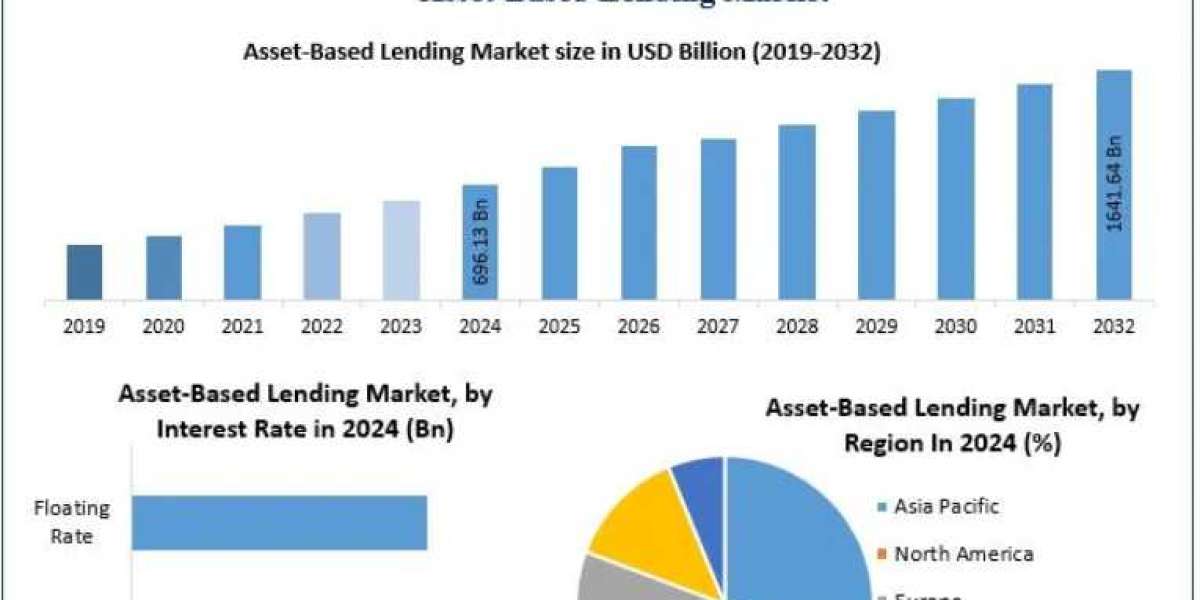

Asset-Based Lending Market Set to Reach USD 1,641.64 Billion by 2032 Amid Rising Demand for Alternative Financing Solutions

Overview

The Global Asset-Based Lending (ABL) Market was valued at USD 696.13 Billion in 2024 and is projected to reach USD 1,641.64 Billion by 2032, growing at a CAGR of 11.32% during the forecast period (2025–2032). Asset-Based Lending has become a vital financing tool for businesses seeking liquidity, flexibility, and rapid access to capital. Unlike traditional loans that rely on credit history, ABL loans are secured using assets such as accounts receivable, inventory, machinery, or real estate, enabling borrowers to unlock the value of their balance sheets.

The market’s growth is primarily driven by increasing credit demand from SMEs, evolving financial product innovations, and the growing need for flexible working capital solutions in uncertain economic environments.

Access your free report sample — uncover the top-performing segments today@https://www.maximizemarketresearch.com/request-sample/189641/

Market Dynamics

1. Easier Qualification Broadens Access to Capital

Asset-based lending provides a more accessible financing alternative compared to traditional bank loans, which often impose stringent requirements regarding profitability and credit history. ABL approvals are largely based on collateral value, particularly accounts receivable, inventory, and equipment, allowing younger or cash-constrained companies to secure funding.

This flexibility has positioned ABL as an essential funding option for SMEs and companies in transition, driving overall market expansion.

2. Rising Liquidity Needs Fuel Market Demand

A key advantage of ABL is its ability to enhance business liquidity and ensure predictable cash flow. For fast-growing companies, seasonal businesses, or firms facing cash flow disruptions, ABL provides stability and a steady capital supply. These features make ABL particularly appealing amid economic volatility and tightening credit conditions.

3. Increasing Role of SMEs in Global Lending

Small and Medium Enterprises (SMEs) are the cornerstone of global economic development, accounting for 90% of all businesses and 50% of global employment. However, an estimated 65 million SMEs face a funding gap worth USD 5.2 trillion annually, according to the International Finance Corporation (IFC).

Asset-based financing offers SMEs an innovative route to access capital using tangible assets—addressing the persistent challenge of underfunding and supporting job creation in emerging economies.

4. Product Innovation Accelerates Growth

Leading financial institutions are introducing new ABL products to broaden lending accessibility. For instance, Metro Bank (UK) launched an ABL solution offering credit of up to USD 2.44 million, backed by various assets such as receivables, machinery, and commercial property. Such innovations are enhancing product diversity, expanding market reach, and strengthening lender-entrepreneur relationships.

Market Trends

The ABL industry is transitioning from receivables-based financing to a more comprehensive asset evaluation model, considering total business assets such as property, raw materials, and machinery.

Technological advancements—such as AI-driven collateral valuation, digital lending platforms, and automated compliance systems—are transforming the efficiency and transparency of ABL operations.

Moreover, the COVID-19 pandemic acted as a catalyst for growth as financially constrained companies shifted from cash-flow-based loans to asset-secured credit facilities, particularly in sectors like retail, manufacturing, and wholesale.

Segment Analysis

By Type

Receivables Financing dominated the market in 2024 and is projected to grow at a CAGR of 9.1%. It enables businesses to convert unpaid invoices into immediate cash flow.

Inventory Financing is gaining traction among retailers and distributors with large stockpiles, providing liquidity during seasonal fluctuations.

Equipment Financing supports capital-intensive industries like manufacturing and construction by using machinery as collateral.

By End User

SMEs hold a significant share due to limited access to conventional financing and greater reliance on asset-backed credit.

Large Enterprises utilize ABL primarily for capital optimization and to strengthen liquidity management during expansion or restructuring phases.

Access your free report sample — uncover the top-performing segments today@https://www.maximizemarketresearch.com/request-sample/189641/

Regional Insights

North America

North America accounted for 37.8% of the global market in 2024 and is expected to maintain dominance through 2032 with a CAGR of 10.12%. The region’s robust financial ecosystem, advanced credit infrastructure, and the presence of leading institutions such as Wells Fargo, JPMorgan Chase Co., and HSBC Holdings plc underpin its leadership.

Europe

The European ABL market is witnessing steady growth driven by regulatory support, strong banking networks, and innovative product offerings from major lenders like Lloyds Bank and Barclays PLC.

Asia-Pacific

The Asia-Pacific region presents immense potential due to the rising number of SMEs, digital transformation in banking, and supportive government policies promoting access to credit. Countries like India, China, and Japan are expected to lead regional growth.

Competitive Landscape

The market is moderately consolidated with a mix of global banks and specialized financial institutions focusing on mid-market clients. Key players include:

Lloyds Bank

Barclays Bank PLC

Hilton-Baird Group

JPMorgan Chase Co.

Wells Fargo

HSBC Holdings plc

Porter Capital

White Oak Financial, LLC

Capital Funding Solutions Inc.

SLR Credit Solutions

Fifth Third Bank

Goldman Sachs Group, Inc.

Santander Bank N.A.

Truist Financial Corporation

These players are focusing on strategic collaborations, AI-driven risk assessment tools, and digital ABL platforms to improve operational efficiency and client experience.

Conclusion

The Asset-Based Lending Market is evolving as a cornerstone of modern finance, bridging the gap between liquidity demand and restricted traditional credit access. With technological integration, product innovation, and SME-driven demand, the ABL industry is poised for robust growth.

By enabling businesses to leverage their tangible assets effectively, ABL not only enhances liquidity but also democratizes access to capital—driving global economic resilience and expansion through 2032.